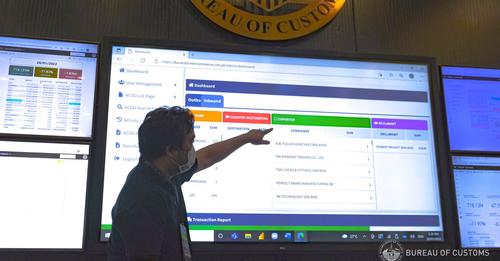

The Export Development Council (EDC) lauds the Bureau of Customs (BOC) for laying out their 10-Point Priority Program for 2022 during the Media Fellowship Meeting on 27 January 2022 at the Port Area, Manila and via Zoom Conference. Such programs are geared towards full automation of Customs procedures to eliminate face to face transactions. More importantly, Import and Export-related programs are also highlighted including the full implementation of the Authorized Economic Operator (AEO) Program and enhancement of trade facilitation.

For more details on this story, kindly click this link.MRJ