It is therefore necessary for regulatory agencies to undertake the RIA process which involves problem definition, setting the objectives, identifying options (from doing nothing or status quo to other options), impact analysis (cost-benefit analysis), comparing options, and implementation and monitoring.

It is therefore necessary for regulatory agencies to undertake the RIA process which involves problem definition, setting the objectives, identifying options (from doing nothing or status quo to other options), impact analysis (cost-benefit analysis), comparing options, and implementation and monitoring.

World Bank strongly suggests that regulatory agencies must subject any proposed regulation to the regulatory impact assessment (RIA), a tool that ensures the quality of regulations through a rigorous, well-defined and evidence-based analysis.

RIA is a process and a document to “clean” the rules particularly those involving high regulatory risks that reduce investment and competition; high transaction costs due to a complex, multi-layered, often arbitrary rules that are vulnerable to corruption; too little market regulation, poor enforcement, and under-institutionalization in policy areas as consumer and environmental protection; and checks and balances, such as an effective judiciary which are weak, harming new entrants.

In a recent training on RIA, World Bank emphasizes that a good regulation should be focused on policy problem, introduced when necessary and proportionate to the risk posed by the policy problem, accountable to those affected by the regulation and those who confer regulatory authority, transparent or consultation based, and consistent, taking into account existing rules and regulations.

Corollary to this, the Office of the President issued Memorandum No. 27, series of 2017 which, directs among others, the NEDA to promote among regulatory agencies the use of RIA and other related tools. In Turn, NEDA now implements the Program on Modernizing Government Regulations (MGR) in cooperation with the Development Academy of the Philippines.

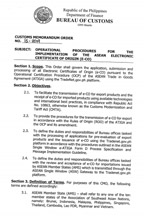

the TradeNet system and attach all documentary requirements by uploading it to the system. If approved, the exporters will receive an email containing a downloadable and printable file for the e-CO. Otherwise, the Exporter/s will be informed of the reason for disapproval through email and may file another application for e-CO.Since the full electronic sharing of e-CO among AMS is not yet operational and while the AMS are addressing all technical failures, “the Exporter shall download then print the e-ATIGA Form D, place his or her signature in the appropriate space, and submit the system-generated ATIGA Form D to the Bureau (BOC) for manual execution of signature and seal”.

the TradeNet system and attach all documentary requirements by uploading it to the system. If approved, the exporters will receive an email containing a downloadable and printable file for the e-CO. Otherwise, the Exporter/s will be informed of the reason for disapproval through email and may file another application for e-CO.Since the full electronic sharing of e-CO among AMS is not yet operational and while the AMS are addressing all technical failures, “the Exporter shall download then print the e-ATIGA Form D, place his or her signature in the appropriate space, and submit the system-generated ATIGA Form D to the Bureau (BOC) for manual execution of signature and seal”.

As the fourth industrial revolution or Industry 4.0 gain momentum, the National Wages and Productivity Commission (NWPC), an attached agency of the Department of Labor and Employment (DOLE), focused its 2018 National Productivity Conference on people-centric technologies & innovation for MSMEs. DOLE Undersecretary Ciriaco Lagunsad, III pointed out that the on-going concern on inflation can also be addressed by improving the productivity of producers which will influence prices. As such, he emphasized the need to embrace new technologies, but put people in control of technology.

As the fourth industrial revolution or Industry 4.0 gain momentum, the National Wages and Productivity Commission (NWPC), an attached agency of the Department of Labor and Employment (DOLE), focused its 2018 National Productivity Conference on people-centric technologies & innovation for MSMEs. DOLE Undersecretary Ciriaco Lagunsad, III pointed out that the on-going concern on inflation can also be addressed by improving the productivity of producers which will influence prices. As such, he emphasized the need to embrace new technologies, but put people in control of technology. Customs Commissioner Isidro Lapeña announced that the Bureau of Customs (BOC) will create a multi-agency body composed of government agencies and port stakeholders and users that will address issues hounding the private sector.

Customs Commissioner Isidro Lapeña announced that the Bureau of Customs (BOC) will create a multi-agency body composed of government agencies and port stakeholders and users that will address issues hounding the private sector. It is therefore necessary for regulatory agencies to undertake the RIA process which involves problem definition, setting the objectives, identifying options (from doing nothing or status quo to other options), impact analysis (cost-benefit analysis), comparing options, and implementation and monitoring.

It is therefore necessary for regulatory agencies to undertake the RIA process which involves problem definition, setting the objectives, identifying options (from doing nothing or status quo to other options), impact analysis (cost-benefit analysis), comparing options, and implementation and monitoring. The Philippine Ports Authority (PPA) issued Memorandum Circular (MC) No. 07-2018 that approves the 7% increase of cargo handling tariff for international containerized and non-containerized cargoes at the two international terminals in Manila. The new rate takes effect on June 5, 2018.

The Philippine Ports Authority (PPA) issued Memorandum Circular (MC) No. 07-2018 that approves the 7% increase of cargo handling tariff for international containerized and non-containerized cargoes at the two international terminals in Manila. The new rate takes effect on June 5, 2018.